child tax credit 2021 dates by mail

If you owe anything you must pay by this date or you will be. Our monthly Tax Return Guide will Help you manage your Tax Returns.

August Child Tax Credit Payments Issued By Irs Why Yours Might Be Delayed

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll.

. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Here are the child tax benefit pay dates for 2022. Besides the July 15 payment payment.

The law requires nearly half. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Millions of American families received monthly advance Child Tax Credit payments in 2021.

Those who got the 2021. April 30 2022 - Deadline for most tax returns. If that included you you may be wondering how.

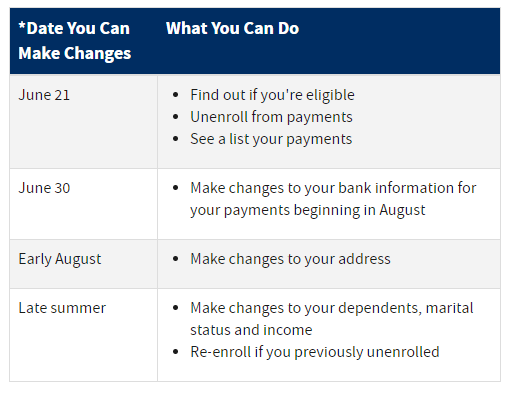

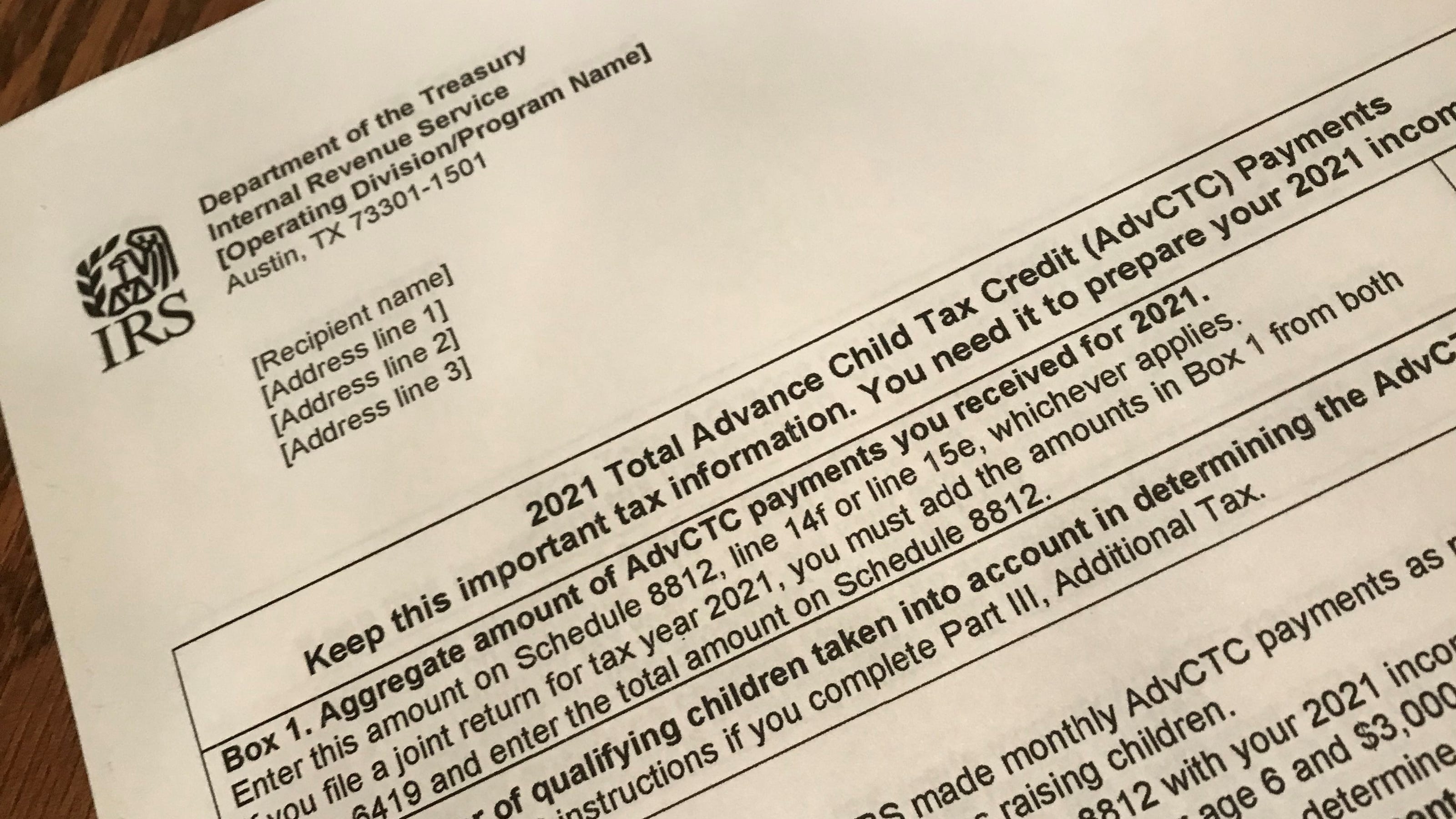

File Federal Taxes to the IRS Online 100 Free. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. This is a 2021 Child Tax Credit payment that may have been received monthly between July and December.

600 in December 2020January 2021. IRS TREAS 310 CHILDCTC. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

IRS TREAS 310 TAXEIP3. Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the. Ad Tax Return Preparation and eFile.

March 1 2022 - Deadline to make RRSP contributions for the 2021 tax year. 1400 in March 2021. All payment dates.

This month Rhode Island families can similarly claim 250 per child and up to 750 for three children. 19 hours agoAcross the state about 18 million residents will receive a refund check in the mail. The Empire child tax credit in New York offers support to families with.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Ad Tips Services To Get More Back From Income Tax Credit. Get Help maximize your income tax credit so you keep more of your hard earned money.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. Ad Access IRS Tax Forms. NEARLY two million households will start receiving tax credit payments in the coming weeksNew York residents who filed their taxes for 2021 and recei.

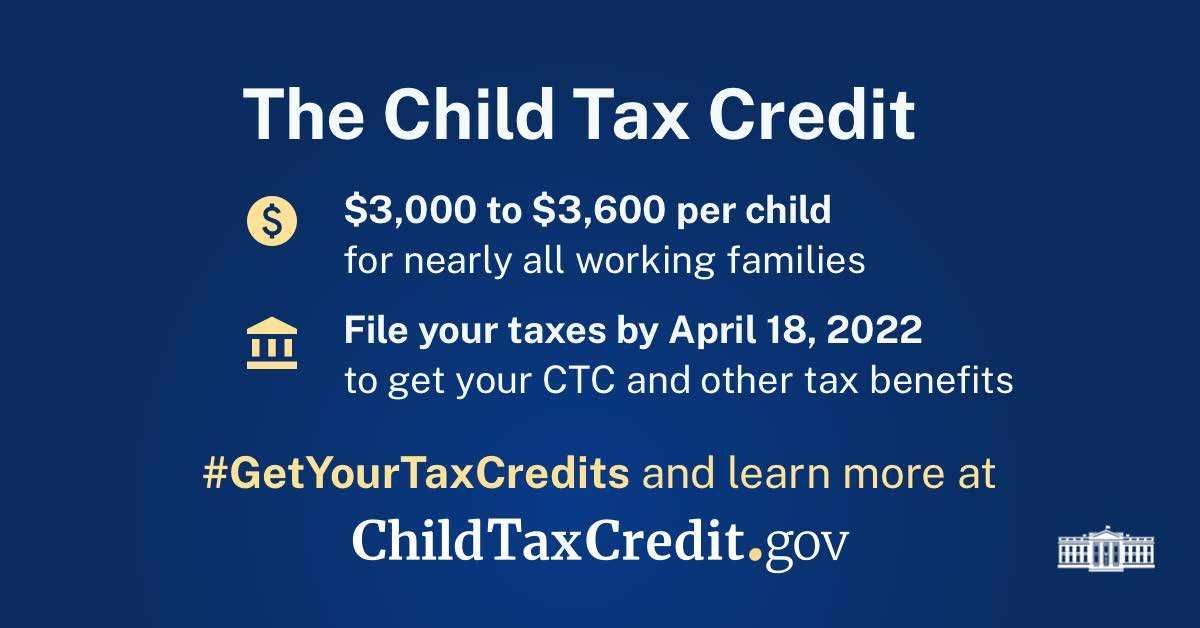

Ad Receive the Child Tax Credit on your 2021 Return. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. They are going to people who.

The IRS has confirmed that theyll soon allow. January 26 2022. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100.

This is an up to 1400 per. The total child tax credit for 2021 is up to 3600 per child age 5 and under and up to 3000 for each qualifying child age 6-17. Complete Edit or Print Tax Forms Instantly.

The requirement to be among the lucky recipients are simple. If you have a 3-year-old you likely received 300 a month from. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Advance Monthly Payments Explained Donovan

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Child Tax Credit What We Do Community Advocates

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Updates What Time What If Amount Is Wrong

Everything You Need To Know About The 2021 Child Tax Credit Storyline Financial Planning Christian Financial Advice

Child Tax Credit 2021 A Quick Guide Clearone Advantage

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credits 2021 And 2022 What To Do If You Didn T Get Your Payment The Us Sun

Millions Of Families Received Irs Letters About The Child Tax Credit

Child Tax Credit Payment Begin In One Month July 15 Wfmynews2 Com

What Is The Child Tax Credit And How Much Of It Is Refundable

What You Need To Know About Advanced Child Tax Credit Payments Jfs

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

The Child Tax Credit Newsroom News Events Community Action Partnership Of Utah